An organization in order to raise money divides its entire capital into small units of equal value. Each unit is called a share.

A share is nothing but an indivisible unit of a company’s capital to be sold among individuals to increase profit of the organization.

A share is nothing but an indivisible unit of a company’s capital to be sold among individuals to increase profit of the organization.

Shareholder

An individual owning one or more than one share of an organization is called a shareholder. In simpler words, an individual purchasing one or more than one share from any private or public organization is called a shareholder.- A shareholder can sell his shares anytime depending on the current value of the share.

- He/she can purchase any new share issued by any other or same organization.

- A shareholder has the right to declared dividend.

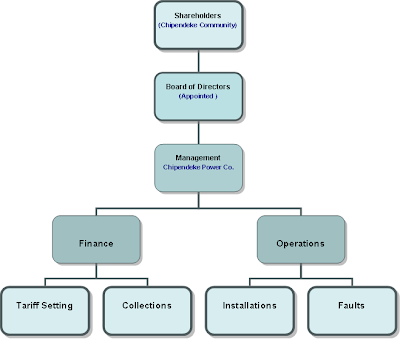

Structure Of Shareholder

Example of Shareholder Certificate

Dividend

Why do people invest in shares ?

An organization pays the shareholders for investing in their company’s shares. The income earned by an individual by investing in an organization’s share (private or public) is called as dividend.

What is Retained Earnings ?

The profit earned by an organization is put into use in the following two ways:

- It is paid to the shareholders as dividend.

- The profit earned by the organization is not distributed amongst the shareholders but is retained and reinvested in the organization. This portion of the income is called retained earnings.

What is a Share Certificate ?

When an individual purchases shares from any organization, he/she is issued a certificate as a proof of his investment. Such a certificate issued by an organization to the shareholders is called a share certificate.Example of Share Certificate

Types of Shares

- Equity Shares

Equity shares also called as ordinary shares are the shares where the

payment of dividend is directly proportional to the profits earned by

the organization. Higher the profits earned, higher the dividend, lower

the profits, and lower the dividend. In an equity share, dividends are

paid at a fluctuating/floating rate.

- Preference Shares

Shares which enjoy preference over payment of dividends are called

preference shares. Shareholders enjoy fixed rate of dividends in case of

preference shares.

- Founder Shares

Shares held by the management or founders of the organization are called as founder shares.

- Bonus Shares

Bonus shares are often issued to the shareholders when the

organization earns surplus profits. The company officials may decide to

pay the extra profits to the shareholders either as cash (dividend) or

issue a bonus share to them.

Bonus shares are often issued by organizations to the shareholders free of charge as a gift in proportion to their existing shares with the organization.

How to buy shares ?

- Find a good broker for yourself. Make sure he has good knowledge about the share market and can guide you properly.

- To invest in shares one needs to open a DEMAT Account for online trading. A DEMAT Account is mandatory for sale and purchase of shares anytime and anywhere.

- An individual needs to have his PAN Card, a bank account, other necessary Identity proofs, address proofs and so on.